Crowded Lanes and Congested Capital

- A V

- Nov 7

- 4 min read

Every day, usually sometime between 5 and 7 p.m. (or any hour in Monterrey apparently), almost every city in the world experiences the same frustrating traffic.

Three lanes of cars suddenly frozen in place. The left lane, which is supposed to move faster, is full of impatient drivers.

The middle lane moves slowly but steadily.

The right lane, meant for turning off, is mostly empty but sometimes used by clever (or desperate) drivers trying to skip the line.

This small moment of urban chaos can actually say a lot about how the financial world works. Looking closely, those three lanes can be seen as the three main asset classes in modern markets. The left lane represents equities, the middle fixed income, and the right alternatives. Each lane attracts different kinds of “drivers,” or investors, each at their own risk or bear with me, speed.

The Fast Lane: When consensus becomes congestion

The stock market often resembles the fast lane on a highway. When traffic is flowing, that’s where everyone wants to be, it feels like progress, momentum, and control all at once. Stocks move quickly, they reward courage, and they give investors the comforting illusion that they’re steering their own direction. When the economy expands and optimism builds, money naturally drifts left, chasing the thrill of acceleration.

But anyone who’s spent enough time on the road knows what happens when too many switch to the same lane: congestion.

The same reflexive pattern plays out in markets. During bubbles, whether it was the tech mania of the late 1990s or the meme-stock rush of 2021 investors crowd into the same trades, convinced they’ll be the ones to outperform and that its not too late.

Economist Hyman Minsky warned of this cycle in "Stabilizing an Unstable Economy", long stretches of calm make people forget risk, encouraging leverage and speculation until the system becomes fragile.

Then one small brake check,

an earnings miss,

a rate hike,

a shift in sentiment ripples through the flow.

Panic spreads, and the market, like traffic, comes to a standstill.

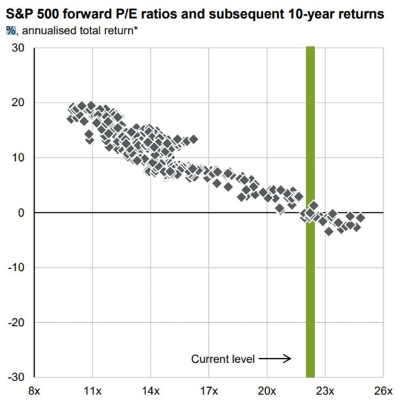

See Below

The left lane rewards confidence, but it never forgives recklessness. When too many people switch at once, the whole system freezes.

This is what economists mean when they say markets are “reflexive” our actions change the system itself. When all investors or drivers are merging or unsure, returns can become constrained.

George Soros called this the feedback loop of finance: belief affects behavior, and behavior changes reality.

2008 Financial Crisis: Rising U.S. home prices appeared to make mortgage-backed CDOs safer, encouraging more borrowing and securitization, inflating prices until defaults triggered a violent reversal.

2022 Market Crash: Investor panic led to mass withdrawals from Silicon Valley Bank, accelerating its collapse, a self-fulfilling run that might have been avoided without the rush to exit.

The Middle Lane: Where Safety becomes Complacency

The bond market is a lot like the middle lane on a highway. It’s where the big, steady players like pension funds, governments, and cautious investors prefer to drive. Bonds don’t offer much excitement, but they promise predictability. They’re meant to be the “safe” option, the lane where you can relax your grip on the wheel.

But, that “safe” doesn’t mean risk-free. When central banks raise interest rates, bond prices fall. That’s exactly what happened around the world in 2022 and 2023, when inflation forced policymakers to tighten monetary policy. Investors who treated bonds as untouchable suddenly faced their steepest losses in decades.

A car might've just broken down a few miles ahead in the middle lane. Gone now is the illusion of "steady ahead in the middle lane".

As economist John Maynard Keynes noted "most investors would rather be conventionally wrong than unconventionally right"

The middle lane feels comfortable precisely because everyone else is there.

When you’re bumper-to-bumper in the middle lane, you don’t blame yourself for the jam; you assume everyone else is stuck too, that it couldn’t have been avoided.

Bond investors think the same way. When the economy slows or inflation surprises, they see it not as a mistake of judgment but as an inevitable consequence of the road itself. In both cases, the feeling of safety comes not from control, but from shared inconvenience.

The Exit Lane: Where innovation meets volatility

Finally we have, the right lane. the one meant for exits, but most often used by drivers who think they’ve found a faster way through. In finance, this lane represents the world of alternative investments and entrepreneurship: venture capital, private equity, and more recently, crypto.

It attracts those who’ve grown restless with the slow pace of traditional finance and want to build or bet on something new. Much like drivers, annoyed at the pace of traffic in the other lanes.

Entrepreneurs and early-stage investors invest here because it offers freedom of movement. They accept volatility in exchange for autonomy. While this lane can be uneven, it is also where wealth creation compounds fastest when conviction meets timing, i.e no blocking cars, hazards or potholes.

And we could go on...

The Fed = Road Signage and Laws

Leverage = Speed

Private Credit = The Elusive 4th Lane

Cash = The Side-Service Road

But the point is clear.

It's not about picking the right lane forever, it’s about understanding the flow. Equities reward risk, Fixed Income rewards patience, and Alternatives reward imagination, but none of them guarantee safety. What matters is judgment: knowing when to accelerate, when to yield and most importantly, when to leave.

Comments